Continue to Hold or Sell a Laggard Mutual Fund?

Q: I invested in the CGM Focus Fund at the end of 2007 as it was recommended in numerous places. It doesn't seem to have done well since and I wonder if I should continue to hold it or sell it and buy something else?

A: The CGM Focus fund is part of a small family of funds managed Ken Heebner. His Focus fund more than doubled in value from early 2007 to mid-2008 which capped off a very good first decade for the fund that had begun operations in 1997.

Money flooded into the Focus fund after its eye popping returns in 2007, thanks in part to all of the gushing media accolades the fund was accumulating around that time. For example, The N.Y. Times published an article, "Three Strategies That Kept Sizzling" that said, "Ken Heebner, manager of CGM Focus, achieved a double distinction with his fund. He placed among the top performers for the most recent quarter and the five-year period. For the quarter, CGM Focus, which invests mainly in large-capitalization domestic stocks, returned 30.3 percent, while for the five years ended Sept. 30, it returned 32.9 percent, annualized...Mr. Heebner sniffs out trends — economic, social or demographic — and then tries to find well-run companies poised to benefit from them."

Kiplinger's also wrote a glowing article referring to manager Ken Heebner's, "brilliance at picking investment themes and the stocks that go best with them." And Heebner even graced the cover of Fortune magazine in June of 2008. The article was entitled, "America's hottest investor: Never mind the rocky market. After a string of supersmart calls, mutual fund manager Ken Heebner is putting up the best numbers of his sterling career."

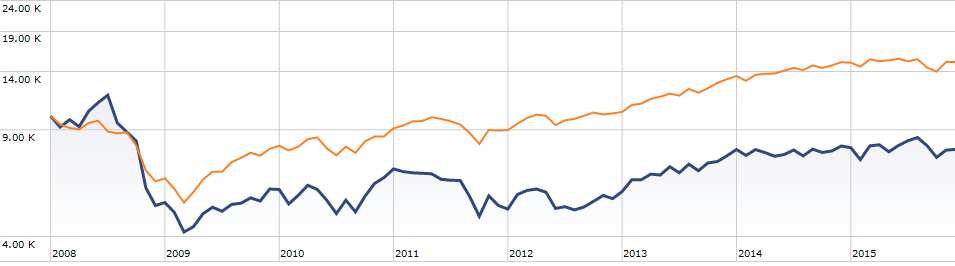

During the severe stock market downturn that occurred primarily late in 2008, CGM Focus got crushed much worse than the overall market. It plunged about 65 percent in just eight months after June, 2008. And over the past six plus years, it has continued to dramatically under perform the market averages (see graph below - CGM is dark blue line, comparable funds are orange line). While the S&P 500 has soared 325 percent since early 2009, CGM Focus is up only 86 percent. So, since its peak in June, 2008, CGM Focus is down 34 percent while the S&P 500 is up 90 percent.

Given the risks that the fund takes and the large number of recent years of underperformance, I would suggest placing your money elsewhere.